What is a Mortgage Broker?

Loans are so confusing!!

Getting a loan these days can be so confusing! It’s such a hassle, there are so many requirements that the lender wants and it seems like you bend over backwards to give them what they want…and then they want more! You waste so much time and energy researching for the right lender, then researching the right loan product and features, working out your budget and if you can make the repayments and then after all that, you may not even get approved, most of the time with no explanation why.

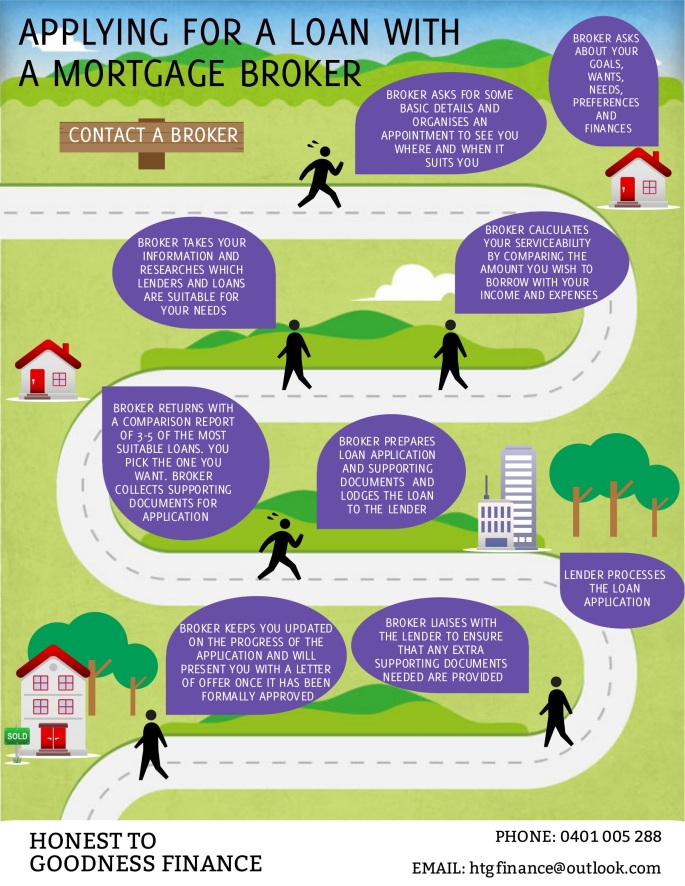

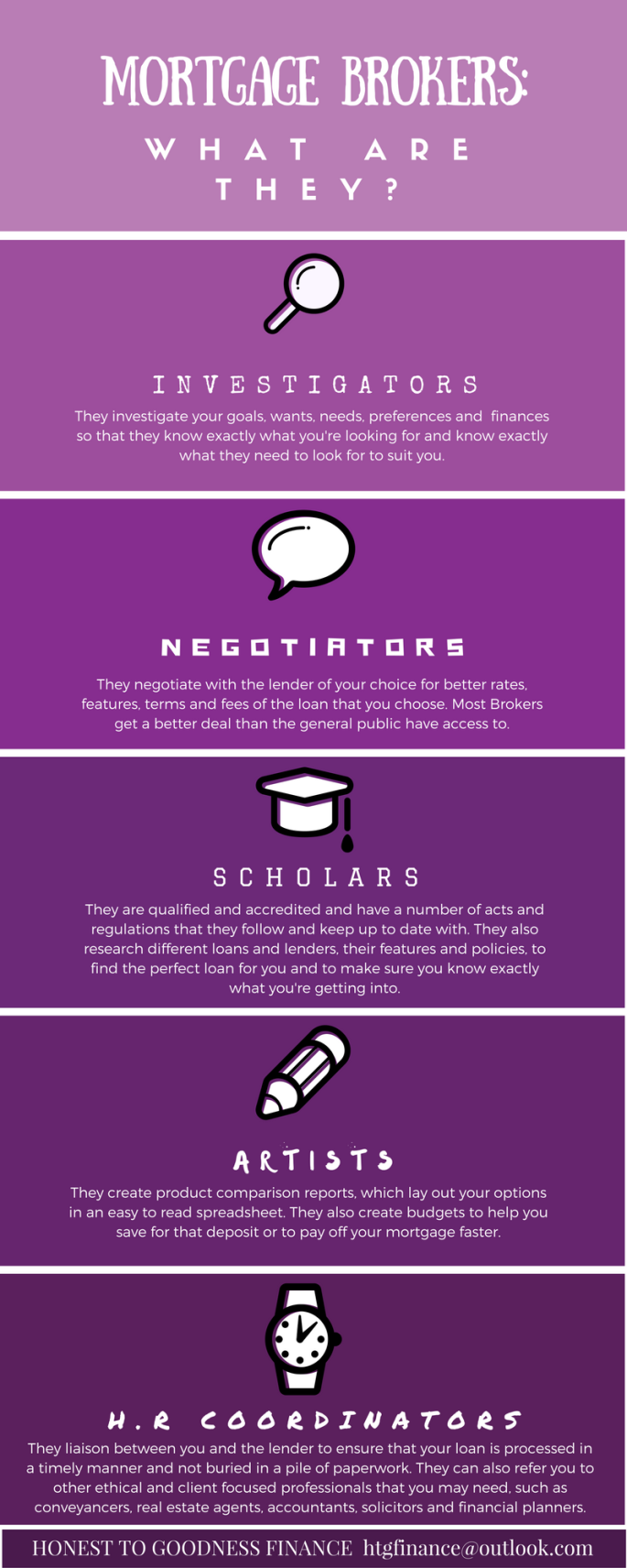

Why not let a professional do all the grunt work for you? After all, it’s usually completely free! You tell a mortgage broker what you want and what your situation is and they do everything else for you, leaving you your precious time to do what you like with it. A mortgage broker will compare a wide variety of lenders for you and hundreds of loan products and then give you a run down of the ones that suit your situation and specified criteria. They can usually access a much better interest rate than the general public has access to and in some situations, they can barter with the lender for a better rate just for you. They will then fill in the loan application for you, all you have to do is provide supporting documents, such as payslips and identification. The loan is then lodged on your behalf, once you sign off on it and the broker will then handle all the communication to the lender regarding your loan, giving you back even more of your precious time.

Did I mention that a broker’s service is usually free? I did and I’ll do it again because it’s almost too good to be true! The fact is, that the lender is the one who foots the bill for the broker’s services in return for your business. But don’t let that fool you into thinking that a broker will set you up with whichever lender will pay them the most. That’s not how it works at all. A broker has access to dozens of lenders and is required by law to act in your best interests and provide you with comparisons for loans that best suit your individual needs and wants. If they don’t, they face being banned from the industry and receiving hefty fines.

So why not give me a buzz or drop me a line today and find out more about how I can assist you with your credit and finance goals? After all, it’s free!!

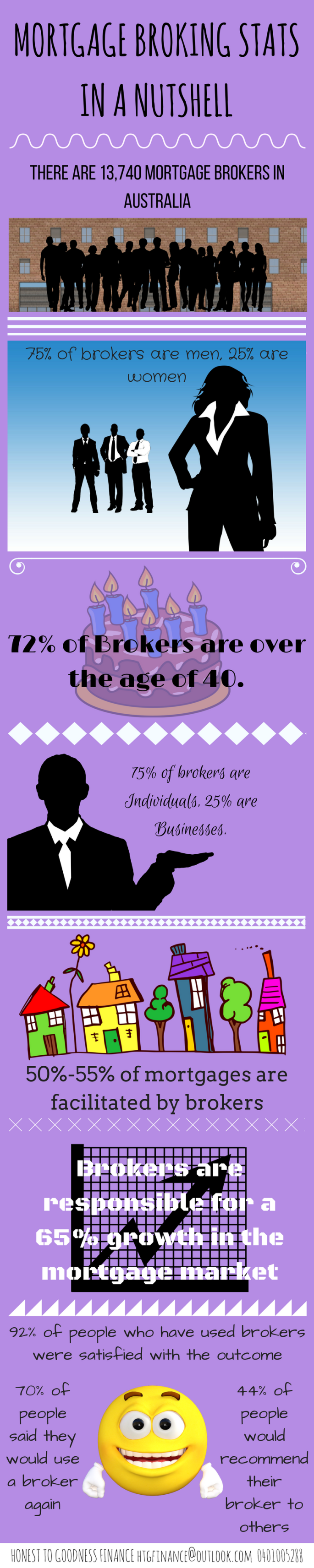

Mortgage Broking Stats in a Nutshell

7 thing you may not have known about Mortgage Brokers

RBA holds Interest Rates at Record Low

At its meeting today, the Board decided to leave the cash rate unchanged at 1.50 per cent.

The global economy is continuing to grow, at a lower than average pace. Labour market conditions in the advanced economies have improved over the past year, but growth in global industrial production and trade remains subdued. Actions by Chinese policymakers have been supporting growth, but the underlying pace of growth in China has been moderating. Inflation remains below most central banks’ targets.

Commodity prices have risen over recent months, following the very substantial declines over the past few years. The higher commodity prices have supported a rise in Australia’s terms of trade, although they remain much lower than they have been in recent years.

Financial markets have continued to function effectively. Funding costs for high-quality borrowers remain low and, globally, monetary policy remains remarkably accommodative. Government bond yields are near their historical lows.

In Australia, the economy is continuing to grow at a moderate rate. The large decline in mining investment is being offset by growth in other areas, including residential construction, public demand and exports. Household consumption has been growing at a reasonable pace, but appears to have slowed a little recently. Measures of household and business sentiment remain above average.

Labour market indicators have been somewhat mixed. The unemployment rate has fallen further, although there is considerable variation in employment growth across the country. Part-time employment has been growing strongly, while growth in full-time employment has been subdued. The forward-looking indicators point to continued expansion in employment in the near term.

Inflation remains quite low. Given very subdued growth in labour costs and very low cost pressures elsewhere in the world, this is expected to remain the case for some time.

Low interest rates have been supporting domestic demand and the lower exchange rate since 2013 has been helping the traded sector. Financial institutions are in a position to lend for worthwhile purposes. These factors are all assisting the economy to make the necessary economic adjustments, though an appreciating exchange rate could complicate this.

Supervisory measures have strengthened lending standards in the housing market. Separately, a number of lenders are also taking a more cautious attitude to lending in certain segments. Growth in lending for housing has slowed over the past year. Turnover in the housing market has declined. The rate of increase in housing prices is lower than it was a year ago, although some markets have strengthened recently. Considerable supply of apartments is scheduled to come on stream over the next couple of years, particularly in the eastern capital cities. Growth in rents is the slowest for some decades.

Taking account of the available information, and having eased monetary policy at its May and August meetings, the Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.

(This information was taken directly from the RBA website; Media Release Statement by Philip Lowe, Governor: Monetary Policy Decision)